What Is a Construction WIP Report?

The work-in-progress schedule (or WIP report) essentially shows contractors whether active jobs are overbilled or underbilled. That difference will boil down to who’s actually funding the project. The goal is typically for project cash to come from your customer, through overbillings (or, billings in excess of costs). However, underbillings (or, costs in excess of billings) can indicate that you’re financing your own projects, and that can put completion in jeopardy and negatively impact the final profit.

In short, the WIP report works by looking at whether you’ve billed over or under the percentage of completion. For example, if your project is 50% complete but only 30% billed, it has underbillings. Underbilled jobs can have the negative effect of drawing cash from other projects to cover costs. They also cause financials to inflate reported revenue. As a result, the company can pays taxes on large amounts of money that don’t really exist. If a contractor were to overbill the job, on the other hand, that could overinflate its cash picture in the short term, which can result in profit fade down the road.

| Overbillings | Underbillings |

|---|---|

| Billings in excess of actual progress | Billings behind your actual progress |

| Customer is funding job costs | Contractor is funding job costs |

| Adjustment artificially lowers income (lower taxes) | Adjustment artificially inflates income (higher taxes) |

As a result, WIP reports are a critical tool for staying on top of projects and keeping them healthy. With just a little collaboration, both project managers and accounting can see how a job is progressing, come to an understanding over issues, and monitor for any red flags. Ultimately, good WIPs can actually help the company support PMs to deliver their jobs on-time, on-budget and as-described.

What’s the Point of WIP?

While contractors can use a WIP report for different key performance indicators (KPI), a WIP report essentially:

- makes sure everyone understands where a job stands

- gets everyone on the same page about billing progress

- proactively monitors for profit fade, cash flow or loss-job issues

WIP reports also calculate how companies should adjust their financials to create an accurate picture while jobs are still in progress. That means underbillings or overbillings can impact your reported revenue and, in turn, what you’re paying in taxes. The goal, then, is to be as accurate as possible so that:

- you can adjust for jobs encountering unexpected difficulties

- your company’s finances are accurate

- you’re not overreporting revenue, which can hurt job profit

That requires companies to make a pretty exact prediction of the future. Accounting can do that with numbers, but some of those numbers have to come from the knowledge, vision and experience of project managers.

How Does a WIP Report Come Together?

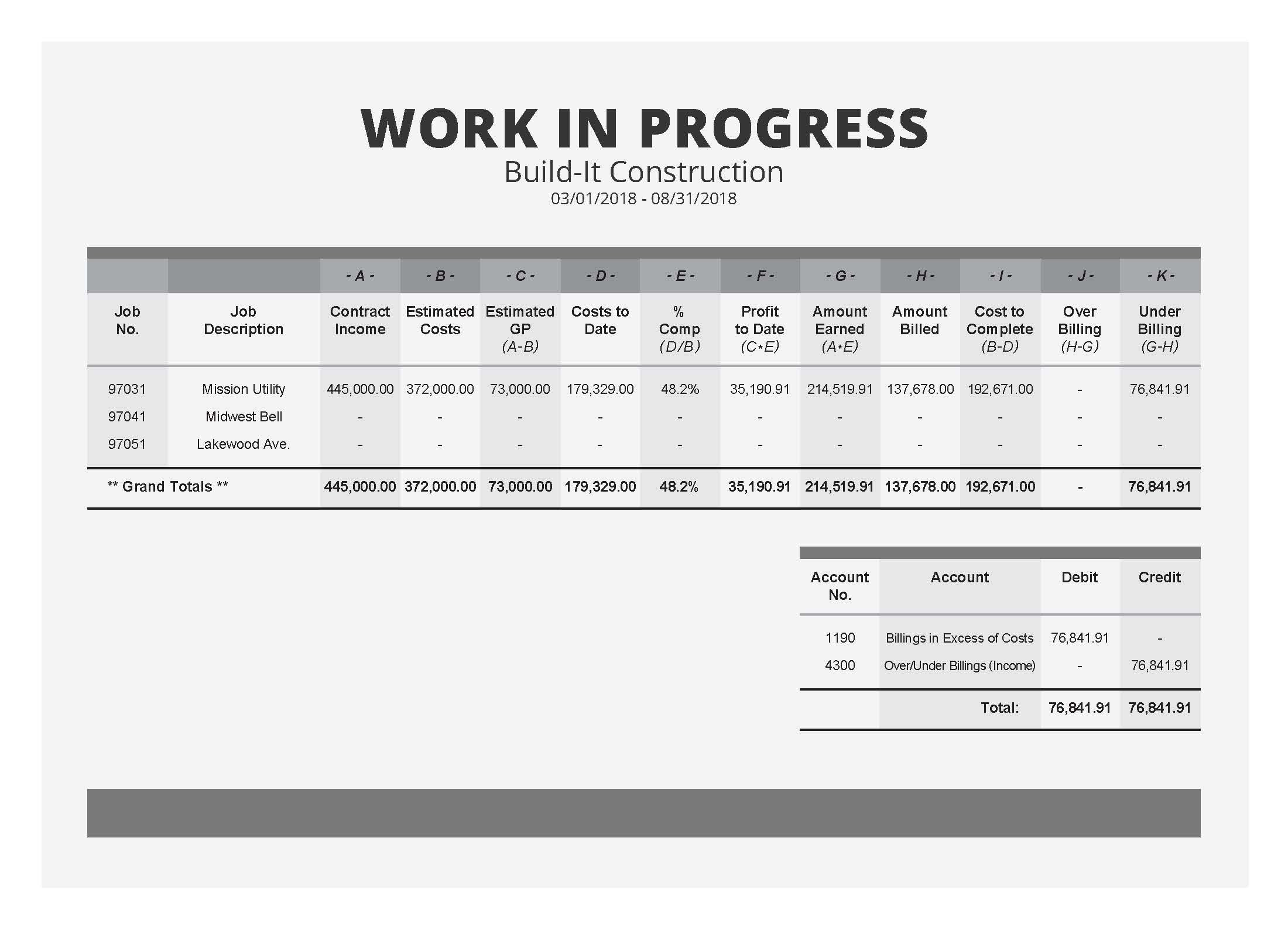

[Sample WIP Report]

Work-in-progress reports will generally include the contract amount, estimated costs, costs to date, the percent complete, billed revenue, earned revenue and over/under billings. However, there’s no single universal format, so it may include other columns like backlog, remaining profit, etc. Each row represents one job.

Dive into this sample construction WIP report by clicking on different areas to learn more:

A. Contract Income

This is the revised estimated revenue for the job, including all approved change orders. It depends on information supplied from project managers. It’s entered directly into the WIP report, or else your construction accounting software will automatically pull it in from your job budget and change orders.

A more complex report could possibly include an additional column for projected income, which would include pending or estimate change orders in order to calculate projected over/underbillings.

B. Estimated Costs

Like contract income, estimated costs come from outside of the report and should include all approved change orders to the budget. This will need to be manually entered into a spreadsheet report or else should pull automatically into the report if you use construction accounting software.

C. Estimated GP

Estimated gross profit is calculated by subtracting your estimated costs from your estimated contract revenue (A-B). In this WIP report, this number will be used to calculate the profit to date.

D. Costs to Date

Current costs to date should be supplied by your construction accounting system.

E. % Complete

In this WIP report, the percent complete is calculated by dividing costs to date by estimated costs (D/B). Different companies might have different ways they prefer to look at or compare the percent complete figures of their jobs, and this can include quantities complete or manual completion estimates.

F. Profit to Date

Contractors can calculate current profit differently on variations of a WIP report. In this sample report, costs to date are multiplied by the percent complete (C*E). Other WIP reports might subtract costs to date from amount earned (G-D). Notice that, because of how percent complete is calculated in this report, you get the same profit to date using either method.

G. Amount Earned

The amount earned takes the contract income and multiplies it by the percent complete (A*E). In other words, it represents the amount that “should” be billable.

H. Amount Billed

Like costs to date, the amount billed to date should be supplied by your accounting system.

I. Cost to Complete

This sample WIP report calculates estimated completion costs by subtracting costs to date from estimated costs. However, companies need to ensure that this is accurate to the field conditions. As long as estimate costs account for all relevant change orders — approved, pending or needed — both accounting and project managers should be able to agree on this critical number.

J. Overbilling

The amount of billings in excess of progress is simply the amount earned subtracted from the amount billed (H-G). However, if this is a negative number, there are zero overbillings. Instead, you’ll have a number in the underbillings column.

K. Underbilling

Calculating underbillings is simply the reverse of overbillings. The amount billed is subtracted from the amount earned (G-H). If the number is negative, there are zero underbillings, which in most cases construction financial managers regard as a positive sign for projects.

$76,841.91

The project in this example is underbilled by $76,941.91. In other words, that’s how behind they are on their billings relative to how much progress they should be able to bill for. The question is, “Why?” Why aren’t they billing more in order to free up more operating cash?

There are numerous reasons why a job can be underbilled. In this case, they’re billing may be caught up to the actual work completed, but their costs are too high relative to the estimate. That may because they’re missing change orders they need to adjust the cost estimate. Otherwise, they’ll be way underbilled, and that has implications for their income statement.

Debit/Credit

Since the job is underbilled, it looks on paper like it holds the promise of future revenue — revenue that won’t show up on the profit and loss statement (P&L) unless accounting makes an adjusting entry. But accounting wants to make the P&L accurate to the job performance. This is why the example is debiting $76,841.91 to an adjusting liability account and crediting the same amount to an adjusting income account.

The problem comes if the underbillings are really a result of higher costs than the revised estimate indicates. In that case, the $76,841.91 being counted on as revenue isn’t income they’ll ever see. When the IRS sees that income statement, though, it won’t matter whether it’s real or not. They’ll be paying taxes on three-quarters of a million dollars they might avoid with good WIP procedures!

WIP reports can look complex, but as you can see in the sample WIP report above, WIP schedules are really built on just a few key numbers:

| Data | Supplied by |

|---|---|

| 1. Costs to date | Accounting |

| 2. Billings to date | Accounting |

| 3. Contract amount | Project managers |

| 4. Cost estimate | Project managers |

As long as these numbers are accurate, the report can calculate everything else, like gross profit, percent complete, overbillings (billings in excess of costs) and underbillings (costs in excess of billings).

One number still demands special attention, however. That’s the project’s cost-to-complete. It absolutely has to be accurate. If not, the cost estimate is off, the percent complete will be off, the over/underbillings will be wrong, and the income statement will be distorted. No one will know how to measure the job properly. Worse yet, it can create unrealistic expectations of project managers and unwelcome surprises that contractors will have to address after the fact.

Why Does WIP Need Project Managers?

If accounting can crunch the numbers, what does it have to do with PMs? Calculating cost-to-complete and percent complete is easy. But what’s true on paper isn’t always true to life. Cost-to-complete isn’t necessarily as simple as what the WIP report calculates: budget – costs to date. Cost-to-complete needs to be an exact estimate, from where the job stands now, to finish on-time and as-described.

Realistically, everyone understands that plans and conditions change on the jobsite. It’s part of construction. Costs can go up; weather delays might demand more labor; conditions can damage inventory; disputed change orders influence the job long before they make it to accounting.

The temptation is to simply keep managing the job to make everything work out in the end — no need to tell accounting! But if the estimated cost-to-complete isn’t true-to-life, the percent complete won’t be accurate and neither will billing expectations. Unreported change orders will make a job look underbilled, resulting in overreported income, higher taxes and lower profit (possibly even lower bonuses!). Everyone will also be looking at a very different project on paper than the field sees in real life, holding PMs to expectations that just aren’t realistic.

As a result, project managers are absolutely critical for WIP reporting. PMs are the experts in knowing the most accurate, real-time costs and what it’ll take to top out. Where a spreadsheet might “think” the job should be 70% done, an experienced PM might look at the whole situation and know there’s no way. That’s an invaluable conversation for construction companies.

That makes good communication essential, then, to get everyone on the same page.

Making the WIP Work in Process

The WIP report gives operations and accounting a common goal, so achieving it requires a little cooperation and a lot of understanding. There’s no one right process for completing good WIP reports, but many contractors make best practices work for them.

In order to successfully complete monthly WIP reports, many construction companies hold weekly meetings on active projects. Some have a one-on-one meeting looking at just one project with the PM and how their change orders can significantly affect the financial picture. Either way, this might sound like a lot of meetings, but when teams run them for everyone’s benefit, people find they actually look forward to them.

Best practices for these WIP meetings include:

1. Being open and nonthreatening.

The idea isn’t to put anyone under a microscope or on the ropes. At the same time, conversations about job progress can make people feel under scrutiny or criticized. So it’s important both to set the tone early and to maintain a healthy one.

WIP meetings need to look at the good, the bad and the ugly. That means spending time on what’s working well, praising the good and learning from it. But it also means facing up to the ugly. Projects have ups and downs. Not every job’s a home run. Companies can ask where projects went off-track without looking to assign blame. WIP conversations sometimes raise hard questions. For WIP meetings to be productive, though, it’s vital they feel safe and keep trust in the room.

2. Making a thorough review.

Of course, WIP meetings should look at actual costs versus the budget, as well as the billing progress. You’ll also want to review the status of change orders, including those pending that aren’t yet in the accounting system. This is also the opportunity to compare the project manager’s percent complete estimate with accounting’s calculation.

Items like the following should raise productive questions for WIP meetings:

- Any underbillings, since these are typically undesirable

- Completion delays that don’t have accompanying change orders

- Overdue receivables

- Unsigned COs on completed work or a large number of unapproved COs

- Any substantial difference between the field’s and accounting’s percent complete

3. Clarifying cost-to-complete.

Many companies ask project managers to bring a budget update to WIP meetings. The team goes over the projected job completion costs together and assesses where projects might need other change orders or adjustments. As long as the estimate to complete is available to accounting, with help from the field, the company has a good chance of completing an accurate, effective WIP report that makes everyone look good.

Conclusion: WIP for the Win

For successful construction companies, work-in-progress reports are team projects. On the one hand, they help measure the health of jobs by monitoring cost and billing issues. On the other, the collaborative approaches that help put WIPs together ensure that the field and accounting are on the same page and actively working toward the same goals. And that’s something anybody can get behind.

As a result, with good WIPs and good WIP practices, everybody can report a win.

Share Article

Keep on current news in the construction industry. Subscribe to free eNews!

Learn about our software more in depth with product overviews, demos, and much more!

Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing (no applying for a TCC code required), mailing to your employees and experienced support to help you.

There are plenty of reasons to make FOUNDATION your choice for job cost accounting and construction management software — just ask our clients!

From job cost accounting software, to construction-specific payroll. Get an overview on your next all-in-one back-office solution.