Guest Contributor: Kevin Bright, ProNovos

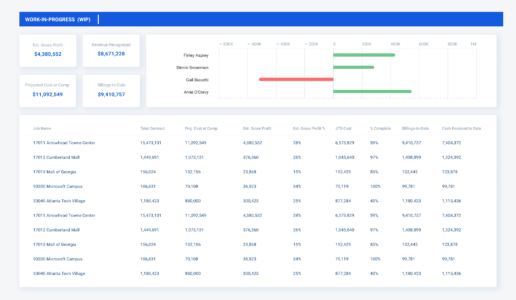

Whether you think of it as “Work-in-Process” or “Work-in-Progress,” the actual function of the WIP is always the same — to communicate project status and profitability in a single report.

Given that the intended audience of the WIP isn’t just internal PMs and execs but also, at times, key external stakeholders such as the bonding agency and the bank, the WIP is incredibly important for every construction contractor.

And that’s why periodically revisiting your approach is a best practice. The goal should always be to convey information that is as actionable (i.e., accurate and updated) as possible. Different contractors measure different things, but generally the WIP is all about estimates and actuals. It will cover the likes of contract amount, gross profit, profit margin percentage, billed to date, backlog, cash flow, job-to-date, cost-to-complete, retainage, pending change orders and earned revenue, to name a few.

Drawbacks of Manual WIPs

Many contractors still manually collect data, put it in a spreadsheet and then spit out the WIP at the end of the month. It’s essentially taking a snapshot of your company and projects at a particular point in time. If it’s early February and you’re looking at numbers from the prior month, you’re essentially looking at the situation in the rearview mirror. Many of those numbers may have already changed.

Increasingly, today’s subcontractors and GCs want to have each individual building block of the WIP automatically flow into the report. It’s faster, easier and more accurate than a manual approach.

With cloud-based automation, as the accounting department posts payroll, that is reflected instantly in the WIP’s job-to-date costs. If a PM posts a change order, the contract amount changes accordingly. Gone is the need to manually adjust project financials in a big push.

Automation also reduces the errors that so often result from manual entry. Simply put, there are fewer opportunities for someone to misspell a name or key in the wrong number. (If you think manual-entry errors are a small matter, just ask the nearest accountant.)

Increased Data Access

Automated, cloud-based approaches to WIP reporting also increase data access to different stakeholders. Those with the appropriate permissions can pull up the report whenever and wherever the need arises, even on a phone or tablet, as opposed to waiting for someone in accounting to send them this month’s spreadsheet.

Good solutions also make it easy to slice and dice the data based on different assumed conditions. What does the WIP look like if you only include projects of a certain size or type, or limit the information to certain timeframes? How about a deep dive into service or time-and-materials contracts? Legacy approaches require you to manually populate these types of custom reports each time you need them. With an automated WIP, it’s as simple as checking or unchecking a few boxes. The information is already there; you just choose how you want to see it.

Visuals and Drill Paths

Automated WIP reporting can also give subs and GCs new ways to see their data. For example, the platform might automatically highlight information that requires immediate attention: Overbillings might be colored green, whereas a red-shaded field could tell you immediately that your HUD project in Fayetteville, Georgia, is concerningly underbilled.

Similarly, you can customize the report to display your most important KPIs — the likes of gross profit, cash flow and over- and under-billings — front and center, instead of having them buried in the report.

Drill paths also allow you to dig deeper to better understand what is happening with your projects and company. You may have seen an “exploded” image of a car or plane where all the individual parts—like the axle and every component of the wheel—hang separately in space. Drill paths allow you to do much the same with your WIP. You could drill into the KPIs on a specific project and then compare them to completed jobs of similar size and scope. Or you could call up the performance trends for specific project managers or do some detective work on how and when profit fade started to happen on a particular job.

Automated WIP reporting allows you to grasp the situation quickly, run your deep dives, and then communicate those insights to those who can use them to advance your goals.

Share Article

Keep on current news in the construction industry. Subscribe to free eNews!

Our Top 3 YouTube Videos

Learn about our software more in depth with product overviews, demos, and much more!

Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing (no applying for a TCC code required), mailing to your employees and experienced support to help you.

There are plenty of reasons to make FOUNDATION your choice for job cost accounting and construction management software — just ask our clients!

From job cost accounting software, to construction-specific payroll. Get an overview on your next all-in-one back-office solution.