If you handle construction payroll, you know it’s not always simple. Between prevailing wage rates, union deductions, taxes for multiple states and localities or even just overtime pay, there’s a lot that goes into calculating the amount your employee receives.

Understanding a construction paycheck is essential for managing your company’s finances. This blog will help break down the parts of a construction paycheck in a general sense and then show how accounting software, like FOUNDATION®, simplifies even the most complex payroll scenarios.

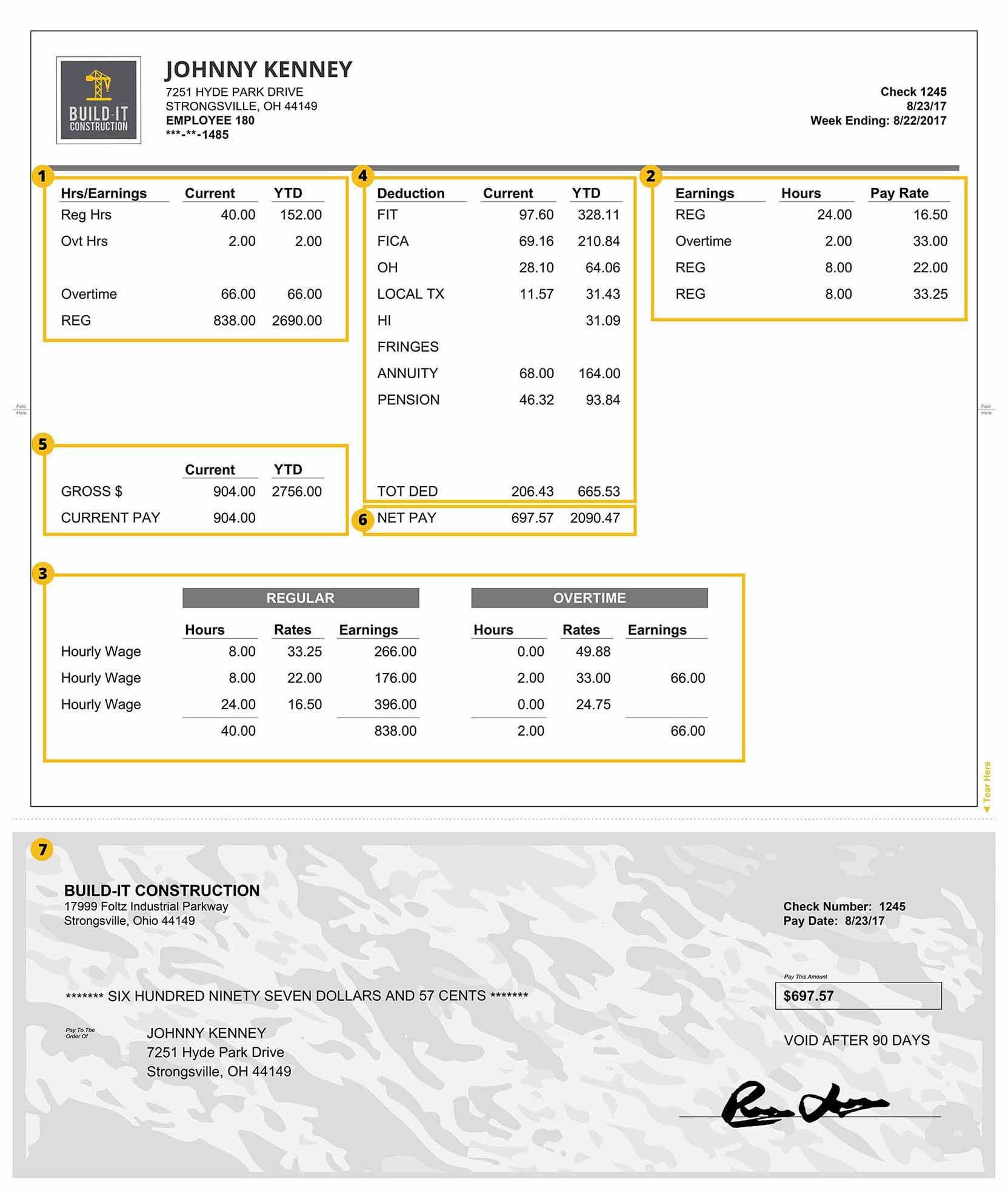

The next time someone asks how their total was calculated, this example paycheck — calculated with FOUNDATION construction accounting software — may help.

Click on each section below to learn more!

Accruals

This section is all about accruals. In this case, it summarizes the “regular” and “overtime” hours, because you can set up FOUNDATION to track when your hours cross the overhead threshold.

It’s also where PTO and vacation accruals you’ve set up in the system appear. For salaried employees, it will show earnings instead of hours.

Additionally, this section displays a year-to-date (YTD) total for each type. YTD refers to totals (hours, deductions, etc.) from Jan. 1 of the current year through the end of the pay period.

Earning Types

This section of a pay stub lists the various earning types on your timecard. In this example, there are only two earning types, but “REG” appears multiple times.

That’s because this employee has multiple pay rates depending on trade, shift or jobsite — all things FOUNDATION construction accounting software can handle automatically with minimal data entry.

Wage Summary

The wage summary breaks out the regular and overtime hours into more detail showing the total earnings for each rate. Underneath, an itemized ‘totals’ line then gives the sum of all regular and overtime hours along with their earnings.

Deductions

Deductions are amounts taken out of an employee’s gross pay. These include:

- Federal Income Tax (FIT): Calculated based on annual income, filing status and gross pay.

- Federal Insurance Contributions Act (FICA): Includes Social Security (a fixed percentage of earnings up to a cap) and Medicare (a fixed percentage without a cap).

- State and Local Taxes: Taxes withheld based on the jurisdictions where work was completed.

- Pre-Tax Deductions: These are amounts deducted from the gross pay before taxes are calculated. They can include contributions to 401(k) plans, health savings accounts and other benefits. Pre-tax deductions reduce the taxable income, which can lower the overall tax burden.

Unfamiliar abbreviations on pay stubs can lead to confusion among employees. Ensuring these are clearly explained can foster transparency and trust. With FOUNDATION construction accounting software, tracking and organizing deductions is streamlined, making it easier to provide employees with detailed and accurate pay stub information.

Gross Earnings

This section contains your gross earnings, the amount earned before any deductions are applied. It also includes employer contributions such as those to retirement plans or health insurance.

The gross taxable amount (labeled as “FIT” on some pay stubs) is calculated by subtracting pre-tax deductions, like contributions to a 401(k) plan or health savings account, from the gross earnings. Federal, state and local tax rates that recognize pre-tax deductions are then applied to this amount to determine current tax withholdings.

It’s worth noting that not all tax authorities recognize all pre-tax deductions. For example, some states may tax certain deductions even if they’re exempt at the federal level.

Net Pay

Net pay, often referred to as “take-home pay,” is the amount issued in the paycheck or direct deposit. It is calculated by subtracting total deductions for the current pay period from the gross earnings.

The Actual Check

The physical paycheck or direct deposit slip shows net pay, the pay date, the check number, and the payee. For direct deposits processed through ACH, this section often includes “VOID” to prevent accidental use as a physical check.

Simplify Construction Payroll with FOUNDATION Construction Accounting Software

Handling construction payroll doesn’t have to be complicated. FOUNDATION construction accounting software streamlines processes like multi-state tax calculations, prevailing wage compliance and benefit tracking.

Chat with a specialist today to learn more.

Share Article

Keep on current news in the construction industry. Subscribe to free eNews!

Our Top 3 YouTube Videos

Learn about our software more in depth with product overviews, demos, and much more!

Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing (no applying for a TCC code required), mailing to your employees and experienced support to help you.

There are plenty of reasons to make FOUNDATION your choice for job cost accounting and construction management software — just ask our clients!

From job cost accounting software, to construction-specific payroll. Get an overview on your next all-in-one back-office solution.