Stop Chasing Payments: What Construction Contractors Really Need in Accounts Receivable Software

Preparing for 2026 Tax Season: What Contractors Should Know After the Big Beautiful Bill

Why Commercial Contractors Choose FOUNDATION® for Their Construction Business

What is Construction Forecasting

The Ultimate Guide to the “Big Beautiful Bill” for Contractors: What It Changes for This Tax Season

Section 179 for Contractors: What It Is, Why It’s Popular and How FOUNDATION® Fits

WIP Reports are Your Secret Weapon for Construction Cash Flow Management

Why MEP Contractors Are Switching to Estimating Software

AIA Billing With FOUNDATION®: Stop Wrestling with Spreadsheets

Make Your Inbox Smarter

Stay up to date with current news & events in the construction industry. Subscribe to free eNews!Our Top 3 YouTube Videos

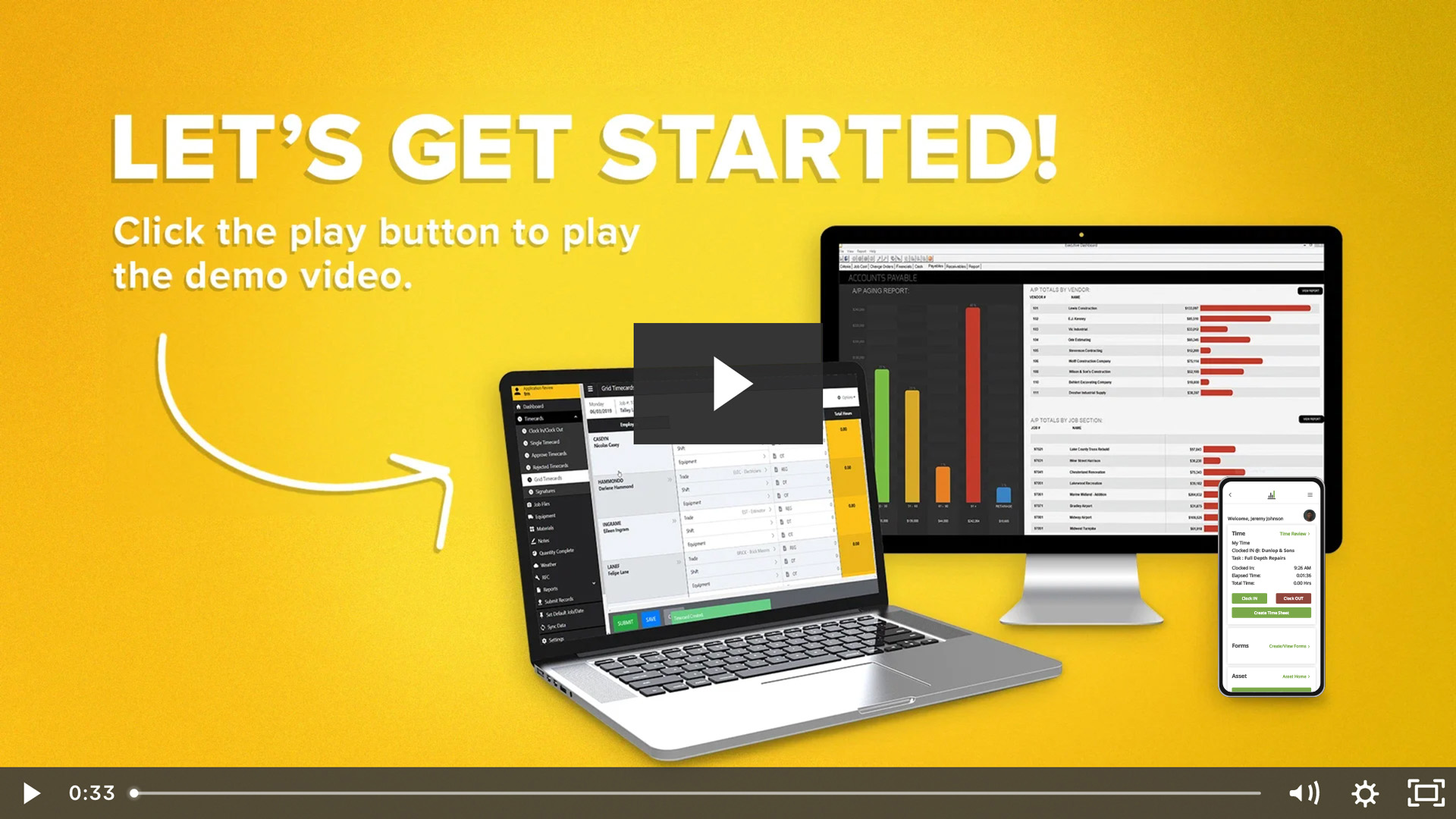

Learn about our software more in depth with product overviews, demos, and much more!

Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing (no applying for a TCC code required), mailing to your employees and experienced support to help you.

There are plenty of reasons to make FOUNDATION your choice for job cost accounting and construction management software — just ask our clients!

From job cost accounting software, to construction-specific payroll. Get an overview on your next all-in-one back-office solution.