Tracking and managing financial information in the construction industry, such as billing and purchasing, can be a complicated task.

Depending on the complexity, some construction projects can be prolonged for years, with a variety of expenses and costs.

The financial control process of job costing is crucial for accurately tracking project costs.

While not mandatory, job cost accounting is highly recommended to avoid serious errors in project budgeting, estimating and cost reporting. According to a survey conducted by QuickBooks®, a significant 25% of construction companies risk going under due to as few as two or three inaccurate estimates. The survey also highlighted labor costs, particularly payroll, as the most difficult and costly to estimate accurately.

Additionally, efficiency and time management will suffer greatly, as managing construction accounting without an effective system could lead to overruns and dwindling profitability.

For any contractor wishing to stay ahead in the field and avoid harmful accounting setbacks, using a job cost system is key. Let’s dive deeper into how job costing helps construction contractors efficiently track their finances.

Key Takeaways About the Benefits of Job Costing in Construction

- Construction accountingleverages job costing to precisely track direct, indirect, and overhead costs, ensuring accurate financial reporting and project profitability analysis.

- Job cost accounting breaks down projects into detailed phasesand cost codes, enabling real-time financial monitoring and facilitating timely accounting interventions to maintain budget integrity.

- Effective job costing accounting improves financial forecasting, enhances cost control measures, and refines future project estimates, significantly boosting overall accounting accuracy in construction.

- Scalable to firms of all sizes, modernjob cost accounting software automates complex financial calculations and generates comprehensive accounting reports, streamlining construction financial management.

Using Job Costing in Construction

Accounting in construction is rarely straightforward because contractors typically work within multiple profit centers (aka managing many jobs simultaneously).

Without a job costing system, tracking expenses per project and monitoring financial data at a micro and macro level can be extremely difficult.

How Job Costing Works

Aimed at industries with considerable accounting complexities, job costing functions as a detailed number system, which accurately identifies, tracks, and analyzes all job-related costs.

Job costing breaks down costs into appropriate parts to record a construction company’s profitability within individual projects.

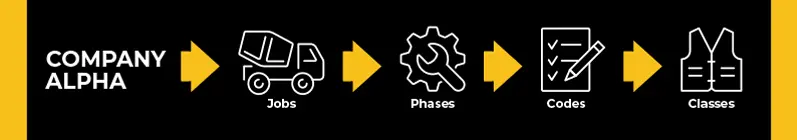

Jobs are broken into individual entities where each cost is specifically numbered and tied to that project. Keeping costs organized within their parent job allows contractors to precisely compare cost estimates with reports.

For contractors to get even more in-depth detail on costs, they can further be categorized into:

- Phases: Once jobs are all separated, phases indicate the most necessary steps and milestones to complete a project. These are high-level pieces of a project that must be met.

- Cost codes: Broken down from phases, cost codes are individualized tasks that must be met to complete a phase.

- Classes: Cost codes are then broken down into classes, which are the most specific and detailed breakdown of a project’s costs.

While not every business may need to be this comprehensive, having a job costing system still allows for these avenues of detailed accounting.

If, for example, a contractor was working on a new building, some of the costs of the project could be broken down in the following way:

- Phase: Foundation work

- Cost code: Inspection and final approval.

- Class: Labor costs.

In construction accounting, job costing remains extremely useful, as its detail-focused structure is perfect for the wide range and high volume of items that contractors must deal with.

How Job Costing Keeps Contractors on Budget

Once costs are broken down and organized, contractors can clearly see where and how any financial oversite might occur.

Then, when a discrepancy is noticed, corrections can be made.

In many cases, these discrepancies can be minor and tough to spot, often getting lost in a sea of accounting data, that if not managed properly, will result in a serious decline in profitability and wreak havoc on a planned budget.

The following example demonstrates this:

- Discrepancy: Due to an unexpected shortage, a contractor orders an additional $500 worth of lumber for a framing project. The contractor purchases the lumber out of pocket to save time, avoid paperwork, and reimburse himself from the budget.

- Impact: This unrecorded expense could lead to budget planning issues on future projects and an inaccurate profitability appraisal.

Job costing can also help contractors compare actual costs with estimates while monitoring their budgets in real-time.

This allows contractors to intervene immediately and adjust, as regular budget updates show tracking and movement of every dollar involved with a project.

And since all costs are tracked accurately in fine detail and organized into codes and classes, resources can be allocated efficiently, allowing for a maximization of profits.

Using job costing to monitor inventory (such as over/under ordered materials or equipment) can help to keep a project budget on track.

Contractors can then easily calculate the total profits earned for a job and make informed decisions on how they would bid on similar jobs in the future.

How Job Costing Can Keep Construction Projects on Schedule

Construction job cost accounting also provides the benefit of in-depth scheduling, which assists with project planning and creating budgetary deadlines and milestones.

If any potential risks are expected, plans can be developed rapidly to resolve the situation and avoid financial damage or significant impact on scheduling.

The following example shows how a job cost system could help avoid budgetary and scheduling conflicts:

- Problem: A complication in material costs results in an unexpected financial increase.

- Solution: With a job cost system, the increase can be flagged, and the impact can be analyzed.

From there, an action plan can be created, including recommendations for finding new methods of material procurement or negotiation, revisions to the budget, and adjustments to the schedule to compensate for loss of profit and time.

Understanding the precise and accurate variables related to job costs, such as time tracking, allows contractors to avoid bottlenecks in the workflow and delays.

Once a budget has been created and profitability calculated, a detailed schedule can be designed and populated by the given construction accounting data.

While these schedules may not remain exact due to unforeseen changes, job costing can help course-correct quickly by identifying risk or resolving last-minute disruptions.

How Job Costing Can Fit Your Construction Company

A construction job costing system can be tailored to fit any company in varying sizes and practices. This includes:

- Small companies: Job costing can be focused primarily on essential tracking, such as labor, equipment, and materials, without bogging the company down with too much data.

- Medium-sized companies: Job cost tracking can become more detailed, monitoring overhead rates and subcontractor expenses while using precise cost controls.

- Large companies: Job costing can be most effective on a large scale, offering advanced features like real-time cost monitoring, predictive analytics and financial reporting, integrated in and ensuring maximum profitability and efficiency.

Because each company is unique in their projects, contracts, and revenue, reporting will always look a little different. Job costing helps assist with a variety of financial report types, including:

- Job Cost reports

- Bid Analysis reports

- Profit and Loss reports

- Budget vs. Actual reports

While reporting can be completed and calculated manually, having a job cost system will help dramatically with accuracy and ultimately save you and the company time and money.

Job cost accounting can be customized to meet any requirements or specific needs, helping businesses improve their financial strength while reflecting accurate profit margins through managing job cost data.

The Benefits of Construction Job Costing Software

While not every business will need to incorporate job costing into their accounting practices, accounting for contractors, especially those working on many projects per year, may not be manageable by hand.

Implementing a job cost system for construction accounting can improve budgeting, scheduling and profitability.

Using job cost accounting software provides even more benefits and tools for contractors.

With job cost software designed for the construction industry, contractors have access to automation, which can streamline all elements of the accounting process, including data management, instant reporting and alerts on overruns or deadlines.

Most construction accounting software also provides mobile and cloud-based access to accounting data, and manual entry options, all organized around high-powered processing, built to handle the full range of accounting needs, from simple to complex.

Even if simple mistakes are made, with construction job cost accounting software, corrections can be made with ease, safeguarding your business’ performance and reputation.

Advance Your Construction Accounting with FOUNDATION® Job Cost Software

In the construction industry, accounting can often be too complex to handle by hand. With a job cost accounting system, a construction business can manage multiple projects with a wide range of costs can be handled with ease.

Job costing allows contractors of any size company to customize tools to their needs, breaking down costs into highly organized jobs, phases, codes, and classes.

From keeping projects on budget and on schedule to maximizing profits and efficiency, job cost accounting is a vital tool to empower companies in the construction industry.

Automated job cost software offers even greater advantages, managing data rapidly and providing options and services not available to companies that create their own job cost system.

At FOUNDATION, we specialize in accounting software that includes all these tools and more. With a longstanding history in the construction industry, we are ready to help you build a secure and profitable accounting system.

Chat with a specialist today to learn more.

Share Article

Keep on current news in the construction industry. Subscribe to free eNews!

Our Top 3 YouTube Videos

Learn about our software more in depth with product overviews, demos, and much more!

Our ACA reporting & e-filing services include official 1094-C and 1095-C IRS reporting, optional e-filing (no applying for a TCC code required), mailing to your employees and experienced support to help you.

There are plenty of reasons to make FOUNDATION your choice for job cost accounting and construction management software — just ask our clients!

From job cost accounting software, to construction-specific payroll. Get an overview on your next all-in-one back-office solution.